NEWS

Messy US GDP figures muddy waters for Fed

by carolina | 26/04/2024

Messy US GDP figures muddy waters for Fed

Yesterday’s US GDP report was troubling for several reasons. Growth slowed more than expected, but inflation was hotter than forecast. GDP expanded 1.6% in the first quarter, well below the 2.4% anticipated while core PCE inflation accelerated to 3.7% from 2.0%. The word ‘stagflation’ has been bandied about a lot since – compared to peers it hardly seems fair. But the US is supposed to be in the peak of health; running a 6% budget deficit and adding $1tn in debt every 100 days is delivering diminishing returns, however.

Was that really a stagflation report? What does the Fed do with this? It was a messy set of data out of the US yesterday. The yield curve flattened, stocks fell, the dollar dipped. The big question is what does it mean and what does the Fed do with it?

Soft GDP suggests rate cuts are back on, but hot inflation and employment market data suggest otherwise…today’s faster PCE data will be eyed with laser focus. And it seems to be the inflation reignition that has caught the market’s attention more than the softness in the growth figures.

Growth was down to its weakest in two years

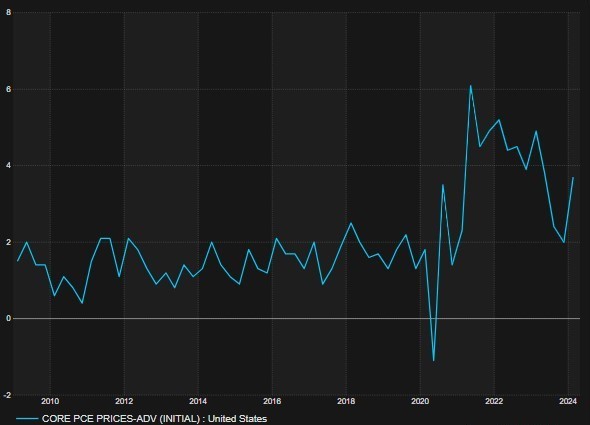

Core PCE reaccelerates

What does this mean? The quarterly core PCE implies a m/m rise of 50 bps to be reported today from the monthly data. That is well above the 0.3% expected and could call for Jay Powell to sound more hawkish next week. The market shifted its full cut from Nov to Dec and the likelihood of the Fed leaving rates unchanged this year has risen to 20%.

FOMC preview

The Federal Reserve is still expected to stand pat on rates next week at the May meeting. In that sense, nothing has much changed since the March meeting. But in every other way things have become a lot more uncertain. Running up to yesterday’s report the market had jumped the shark and started to price in a potential hike as the next move by the Fed. Now rate cuts bets have been pushed further out.

Standing Pat

Markets see virtually no chance of a change in rates, with the fed funds rate to remain unchanged at 5.25-50%.

It is likely they will reiterate that cuts won’t come until policymakers have “greater confidence that inflation was moving sustainably toward 2 percent”.

The question is what they make of that data point and today’s monthly PCE numbers. In March Fed chair Powell looked at some hot inflation readings and was reasonably unfazed: “We don’t really know if this is a bump on the road or something more. We’ll to have to find out.” What is becoming clearer is that it’s not transitory.

The messaging will be a lot more like it was a couple of weeks ago before the blackout period when Powell said recent inflation data indicated that “it’s likely to take longer than expected” for the FOMC have confidence inflation is returning to 2%. As mentioned here several times, I don’t think the Fed really wants inflation back to 2% – looser policy and higher inflation is good for the debt burden. The question is one of credibility in the short term – ultimately I believe they will move the 2% goalpost. After all, it always was a kind of arbitrary figure to land on as the target.

Market Pricing Has Changed A Lot

The market had priced around an 85% chance that the first 25bps cut would happen in June, with three 25bps cuts being delivered during 2024.

The inflation element of the GDP changes a lot. If growth decelerates just as inflation accelerates then the chances of a cut diminishes a lot. And we have had three straight upside surprises from the CPI reports. Markets have trimmed bets of a cut in June to just 11% – it’s totally flipped round in the last month or so.

What Chance a Hike?

Options market price were implying a 20% chance that the Federal Reserve will raise interest rates within the next 12 months…but I think that has fallen back because growth is just not strong enough. You had this narrative about the strength of the labour market and the economy and it looks more like the employment figures are masking an economy that is maybe nowhere near as tough as we thought. A hike now would be reckless. They just need to accept inflation will be 3-4% now and be happy about it.

To sum up, higher inflation per unit of growth takes the goldilocks soft landing scenario off the table – they will have to make a decision. It’s also a fact now that the 6% budget deficit in the US is all that is keeping the economy afloat. And the Fed will have to answer another question – why, once again, have they been taken surprise by inflation?

Neil Wilson

Chief Market Analyst at Finalto

All opinions, news, research, analysis, prices or other information is provided as general market commentary and not as investment advice and all potential results discussed are not guaranteed to be achieved. The information may have been derived from publicly available sources, company reports, personal research, or surveys. Past performance is not indicative of future performance. Trading carries risk of capital loss. Service available to professional clients only.

Related News & Events

Private Credit: Rough Water Ahead or Smooth Sailing?

Finalto attending iFX EXPO Asia 2025 as Platinum Sponsors

Countdown to iFX EXPO Asia 2025: Q&A with Mallika Tan